Strategy

Investors > Boreo as an investment > Strategy and financial targets

Strategy

Our roots are in the North and our company name Boreo mirrors both our cultural heritage and the location of our operations. Boreo – the former Yleiselektroniikka - creates value by owning, acquiring and developing small and medium-sized companies in the long-term.

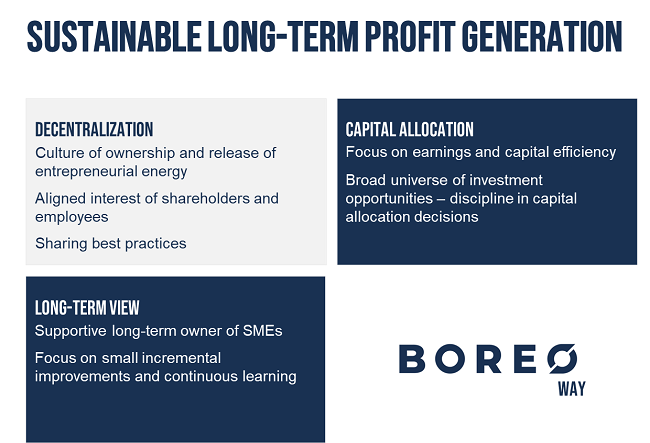

Boreo has successfully executed its strategy and created shareholder value during 2020-2022. In the coming years the focus is on sustainable long-term profit generation*. The execution of the Boreo Way and reaching the primary objective takes us towards reaching Boreo's broader purpose, i.e. being The Best Place for its Companies and People to Grow and Prosper.

*The long term in strategic financial targets refers to a period of five years or more.

Focus on earnings growth and return on capital

To reflect an increased focus on the key drivers of value creation, Boreo updated on 27 September 2022 its long-term strategic financial targets as follows:

Minimum 15% average annual operational EBIT growth

Minimum 15% Return on Capital Employed (ROCE)

Net debt to operational EBITDA between 2-3x

Boreo’s dividend policy is to pay an annually increasing dividend per share, taking into consideration capital allocation priorities.

The Boreo Way

Read more about our strategy areas

Decentralized organization add

The Group operates in a decentralized operating structure promoting culture of ownership and local decision-making. Companies and their local management conduct operations independently within the framework of financial and non-financial targets set by the Group. Each company has a long-term strategic plan in place that establishes the common view of future development of the companies and creates the basis for autonomous our philosophy - boreo way local operations. The Group is steered based on setting targets for key performance indicators and a systematic follow-up and benchmarking of companies on a monthly, quarterly and annual basis. The local management has a high level of freedom in the way of managing the companies towards the strategic goals.

Boreo pays great attention to aligning interests of its employees with those of its shareholders. At the end of year 2023, key employees hold approximately 6% of the share capital of the Group. Company-level incentives in line with the Group’s long-term strategic targets are in a key role in the steering model of the Group. The incentives of local management are based on Return on Trade Working Capital (minimum mid- to long-term target level of 50%) and on a company-by-company basis set target for earnings growth. Given the capital light nature of Boreo’s business operations, the earnings growth and operative return developments drive the Group level returns. Going forward and considering the increasing importance of sustainability matters, the management by objectives -framework will be complemented with sustainability KPIs.

Benchmarking and sharing of best practices are key processes in Boreo for driving long-term performance and promoting a healthy competitive spirit in the Group. The key employees of the Group for example gather annually for seminars and workshops that are focused on sharing experiences and learning from each other.

Capital allocation add

Boreo’s capital allocation mindset and criteria define the financial profile of companies Boreo owns in the long-term, the key principles along which the companies are managed, and the process & principles used in allocating capital to maximize shareholder returns.

In Boreo’s capital allocation philosophy acquisitions and organic investments are of equal importance and for example thresholds for acquisitions and organic investments are the same. In achieving great long-term results, acquisitions play an integral role as Boreo’s companies are often small, operate in industrial niches and allocating incremental amounts of capital to such businesses is often challenging. Hence, acquisitions completed with reasonable valuation levels (average of 5x EV/ EBITDA in 10/2020-2023) are an important source of long-term returns for the company.

Boreo’s strategic targets (minimum 15% average annual operational EBIT growth, minimum ROCE of 15% and leverage 2-3x) reflect the Group’s focus on profits, cash flows, returns and financial stability. To reach its long-term targets, Boreo acquires companies with ability to generate earnings growth and high returns on capital. In working with its portfolio, Boreo invests in the growth of its companies which generate a high return on capital (minimum 50% ROTWC) and can continue to grow with an attractive return profile. In addition, in companies which operate below the minimum 50% ROTWC-threshold, the parent company & business areas support its companies to complete short- to medium-term transformation and reorganization programs. Actions in such situations might include exits from low margin businesses (such as the SANY excavator business exit in Finland and in Sweden in 2023) providing an opportunity to achieve better returns for the resources tied into such operations.

Large amount of allocation opportunities and thresholds for investments have an important role in Boreo achieving the best possible return for the capital deployed to new ventures. To create a broad range of investment opportunities, Boreo works together with its key employees, wider organization and external stakeholders in opportunity sourcing and development of internal capabilities. The more opportunities Boreo has in its allocation funnel, the better the ultimate capital allocation end-result at Group level will be.

Long-term view add

Boreo views a long-term approach to be a key component of its value proposition as an owner of small and medium sized companies. The approach of appreciating the long-standing work done by entrepreneurs, the local knowledge and the ability to take a long-term view is one of the key differentiating factors against other forms of ownership. The long-term view is an overarching principle that impacts both the company’s long-term strategic decisions and day-to-day activities.